Audit & Assurance

Independent, accurate and compliant reporting.

Our chartered accountants deliver comprehensive audit and assurance services tailored for businesses of all sizes.

Whether you’re a small / medium enterprise or a large group – including subsidiaries of international companies – we bring the technical knowledge and experience to meet statutory obligations, manage risk, and help you make informed business decisions.

Our dedicated audit division supports a wide range of services from statutory audits and internal control reviews to fraud investigations and due diligence – ensuring your financial reporting is accurate, compliant and reliable.

Our services

- External audits and reviews

- Agreed upon procedures

- Internal audits and system/control reviews

- Fraud investigations

- Trust-account audits (e.g. for solicitors, real estate, travel agents)

- Financial reporting and advisory

- Due diligence and compliance reviews

- Technical accounting advice

Why choose Economos

Deep Expertise & Experience

Economos has a long history in professional services, offering audit support to businesses of varying sizes, including multi-million-dollar companies. Our audit and assurance capabilities includes large private entities, multinationals, not for profit organisation and charities, ASX listed companies, public non-listed entities and Australian Financial Services License audits.

Comprehensive Services

Our scope is broad: external audits, internal audits, system and control reviews, fraud investigations, trust-account audits (e.g. for real estate or travel agents), due diligence, grant acquittals, compliance reporting for not-for-profits, AFSL’s and more.

Our service offering includes sectors in property constructions, medical, financial services, not for profits telecommunications and various other small to medium enterprises.

Regulatory Knowledge

We stay up to date with evolving legislative requirements including the Corporations ACT 2001, ACNC Act 2012, Charitable Fundraising Act 1991 (NSW) and Charitable Fundraising Regulation 2021 (NSW). We also ensure audits and reports meet the requirements under the relevant Australian auditing standards (e.g. AAS relevant to your engagement.

Tailored for Your Business

Whether you are a small business, a large private company or a not-for-profit organisation, we adapt our approach to suit your compliance needs, operational complexity and reporting obligations. We use appropriate audit specific technology to ensure risks are appropriately addressed with due consideration to the size of your organisation.

Risk Management & Peace of Mind

Our audit and assurance services help you identify control weaknesses, detect potential fraud or compliance issues, and provide clear, reliable reporting - that supports sound governance and decision-making.

Hear from our clients

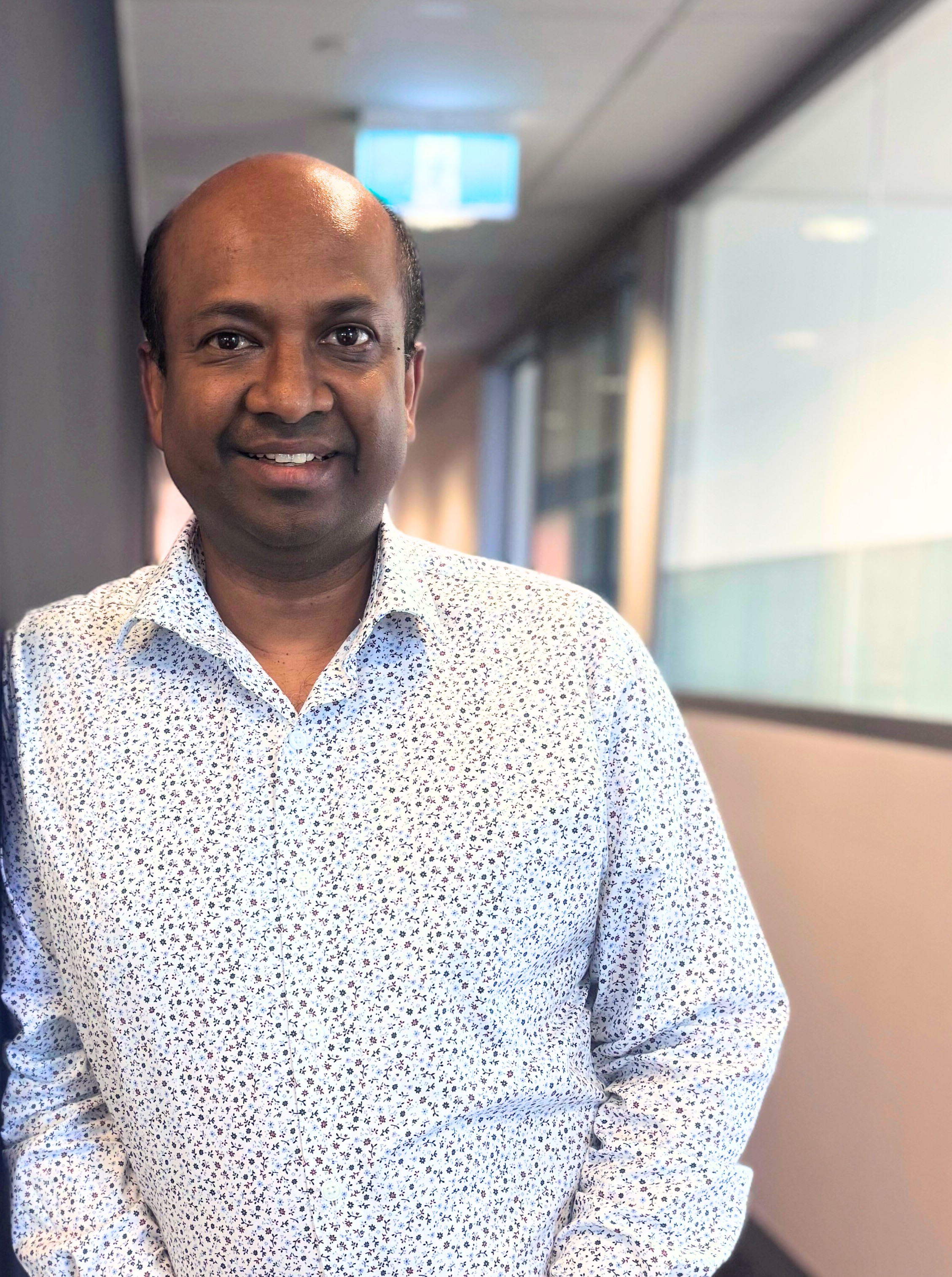

Contact our audit specialists

Economos is staffed by a passionate team of accounting and finance professionals. Our experienced and globally connected Directors oversee a team of over 50 chartered accountants and certified financial advisors who are personally invested in our clients’ success.

Frequently asked questions

Audit and assurance refer to professional services that independently examine an organisation’s financial records, internal control systems, and compliance with statutory/regulatory requirements. An audit is a formal, detailed examination (e.g. of financial statements), whereas assurance may involve broader services such as internal control reviews, compliance checks, due diligence, and other evaluations.

Audit requirements depend on your company type, structure, size, and regulatory obligations. Many small proprietary companies may not be mandated to audit annually. However, some private companies or not-for-profits choose to undertake regular audits for transparency, risk management, or stakeholder reporting.

Independent audit and assurance provide transparent, accurate financial and operational information, reduce the risk of fraud or misstatements, strengthen internal controls, improve compliance with laws and regulations, enhance credibility with stakeholders (like lenders, investors, regulators), and support better business decision-making and governance.

We work with a wide range of clients – from small and medium-sized enterprises to large private companies, international subsidiaries, not-for-profits, government-funded agencies, and organisations required to maintain trust-accounts (e.g. real estate agencies, solicitors, travel agents)

A professional audit or assurance engagement can help you uncover errors or weaknesses, identify gaps in internal controls, and put in place better procedures – helping to avoid compliance breaches, regulatory penalties, or financial misstatements.

If you’re preparing to list your entity on the ASX, you’ll need to present at least three years of audited financial statements. With careful planning, this process can be smooth and manageable. Leaving it to the last minute, however, can create unnecessary stress and impact your timelines.

Start early—speak to our Audit Team today to ensure your listing journey is seamless.